In the rapidly evolving landscape of banking, Customer Experience Management (CEM) has emerged as a critical focus for financial institutions aiming to enhance customer satisfaction and loyalty.

As consumer expectations soar, banks are compelled to adopt innovative strategies that prioritize seamless interactions across multiple channels. With a staggering percentage of customers citing poor service experiences as a primary reason for dissatisfaction, the urgency for banks to refine their customer journey has never been more pronounced.

This article delves into the multifaceted world of CEM in banking, exploring the pivotal role of technology, the significance of personalized service, and the best practices that can help institutions navigate challenges and enhance their overall customer experience. As the industry shifts towards a more customer-centric approach, understanding these dynamics will be essential for banks striving to thrive in a competitive market.

Understanding Customer Experience Management in Banking

Client Experience Management (CEM) in banking represents a critical component of banking customer experience management, encompassing the strategies and processes that financial institutions employ to enhance and streamline interactions across diverse touchpoints. As we approach 2025, the significance of CEM has reached unprecedented heights, with 43% of clients citing inadequate service interactions as a primary source of dissatisfaction. This statistic underscores the imperative for financial institutions to not only address client grievances but also to proactively elevate the overall client experience.

A profound understanding of client needs, preferences, and behaviors is paramount for crafting a seamless and personalized banking experience. Recent trends indicate that 73% of clients utilize multiple channels during their financial interactions, thereby highlighting the necessity for institutions to adopt an omnichannel strategy. By systematically monitoring service statistics, financial institutions can set realistic performance benchmarks and identify operational inefficiencies, ultimately tailoring services to better align with client expectations.

A case study titled “Impact of Service Statistics on Business Performance” exemplifies how the analysis of these statistics empowers financial institutions to enhance client interactions, formulate strategic improvements, and contribute to overall revenue growth.

The impact of effective banking customer experience management on client loyalty is profound. As banks endeavor to cultivate loyalty and trust, they must acknowledge that a positive client experience is directly linked to increased retention rates. Organizations that prioritize banking customer experience management are statistically more likely to experience significant revenue growth, as satisfied clients are more inclined to remain loyal and advocate for offerings to others.

Expert insights emphasize that the future of support in banking hinges on continuous, AI-driven advancements. By leveraging cutting-edge technologies such as AI agents and personalized recommendation systems, banks can refine their service offerings and foster more engaging client interactions. For instance, IKEA’s successful deployment of Google Cloud’s Recommendations AI illustrates how personalized suggestions can substantially boost engagement and sales.

Likewise, AI agents, capable of comprehending natural language and learning from interactions, can deliver instantaneous responses to inquiries, mitigating delays in response time and enhancing overall satisfaction. This capacity to learn and adapt not only enriches interactions but also bolsters operational performance by streamlining processes and curtailing response times.

This focus on AI-driven enhancements is essential for financial institutions seeking to maintain competitiveness and meet evolving client expectations. Case studies reveal that institutions implementing effective banking customer experience management strategies have not only improved satisfaction but also fortified their market position.

In conclusion, the importance of banking customer experience management within financial institutions transcends mere service; it is an integral aspect of an organization’s overarching strategy to cultivate lasting relationships with clients. As the landscape continues to evolve, banks that prioritize client satisfaction through personalized recommendations and robust AI support systems will be strategically positioned to thrive in a competitive market.

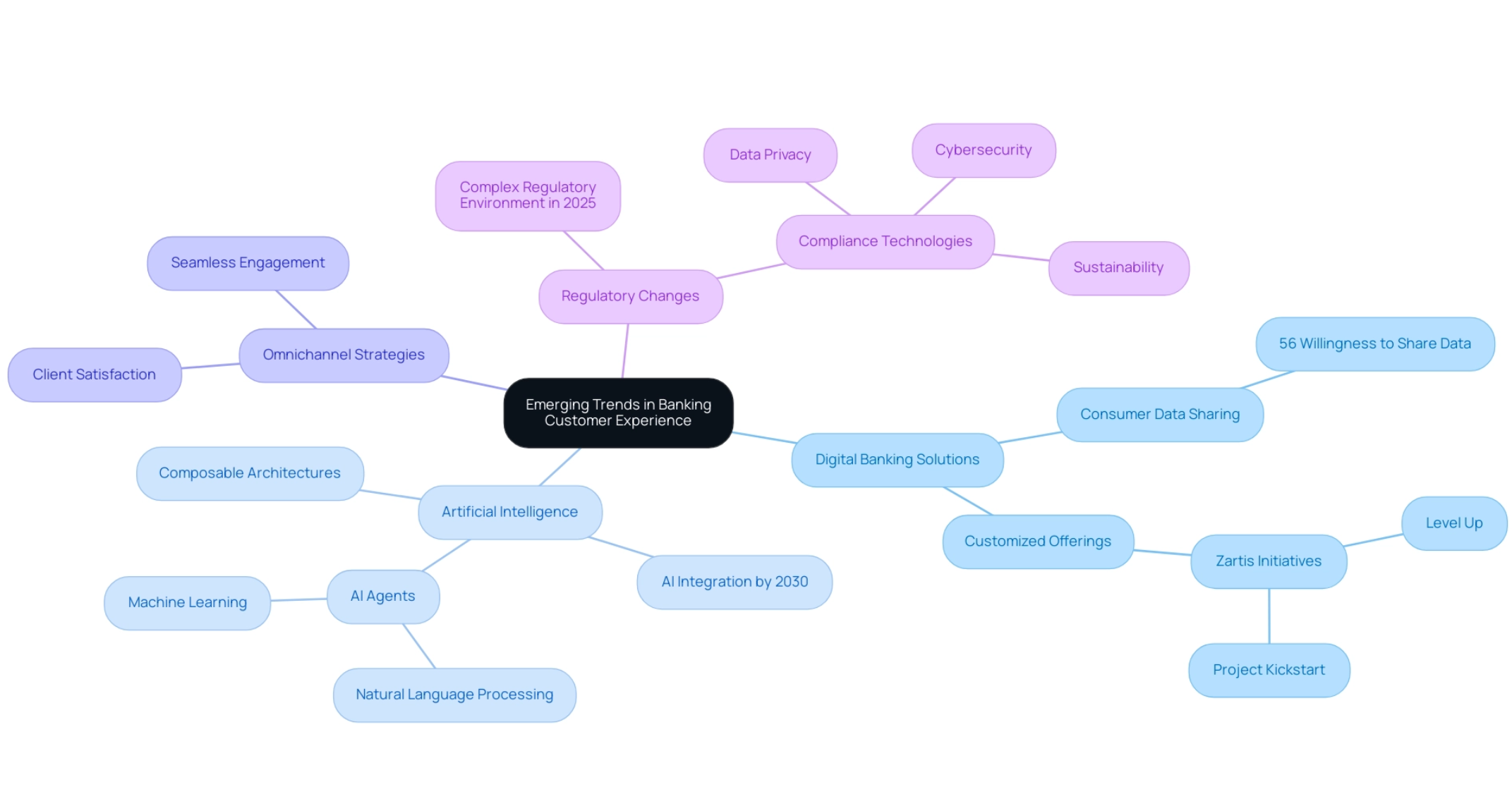

Emerging Trends in Banking Customer Experience

The terrain of client interaction in banking is undergoing significant transformation, driven by several key trends related to banking customer experience management. Firstly, the adoption of digital banking solutions is surging, with a notable 56% of consumers expressing willingness to share their data in exchange for enhanced experiences. This shift highlights the increasing need for customized offerings designed for specific individual requirements, a dedication that organizations like Zartis demonstrate through efforts such as supplying internet access for students in different areas, including Afghanistan and Europe, via their successful initiatives like Level Up and Project Kickstart.

Artificial intelligence (AI) is playing a crucial role in this evolution, allowing financial institutions to enhance client interactions and optimize delivery. As generative AI technologies progress, banking institutions are increasingly adopting composable architectures, enabling improved integration and customization of offerings. By 2030, it is anticipated that AI integration will become standard in banking solutions, paving the way for innovative, AI-driven products.

A relevant case study titled “Platform Providers Face the Innovator’s Dilemma” illustrates how generative AI is pushing SaaS and banking platform providers to adopt these architectures for enhanced integration and customization.

Moreover, banks are prioritizing omnichannel strategies, ensuring that clients can engage seamlessly across various platforms, from mobile applications to in-branch services. This holistic approach not only enhances client satisfaction but also fosters loyalty in an increasingly competitive market. Ongoing feedback loops and prototype testing are crucial for client-focused banking, enabling institutions to adjust their offerings based on real-time client insights.

In 2025, the regulatory landscape will become more intricate, compelling financial institutions to adopt compliance technologies that address new rules focused on data privacy, cybersecurity, and sustainability. As emphasized by industry specialists, including Sharanya Ravichandran, VP of Design at JPMorgan Chase, “If businesses want to remain competitive and be innovation leaders, they must concentrate on these changing client requirements.” Staying attuned to these needs is crucial for maintaining competitiveness and driving innovation.

Grasping these trends is crucial for banks striving to improve their client interactions and stay pertinent in a swiftly evolving landscape. By leveraging digital solutions and prioritizing banking customer experience management, financial institutions can effectively navigate the challenges ahead and deliver exceptional service. Moreover, the incorporation of AI agents, equipped with capabilities such as Natural Language Processing and Machine Learning, can greatly enhance response times and operational efficiency, further improving the overall service quality.

These AI agents can seamlessly integrate with CRM and support systems, ensuring that interactions are informed by their history and preferences, ultimately reducing delays in response time.

Leveraging Technology to Enhance Customer Experience

Technology is fundamentally transforming customer experience management within the banking sector. By 2025, banks are projected to automate up to 90% of client interactions through AI-driven chatbots, significantly enhancing operational efficiency and customer satisfaction. These chatbots, powered by artificial intelligence and machine learning, are designed to grasp the nuances of user interactions, providing instant support and effectively streamlining inquiries.

As stated by Zendesk, “Only Zendesk AI is trained on the world’s largest CX dataset, allowing it to understand the intricacies of client interactions.”

Before implementing these technologies, it is crucial for banks to define their business objectives, such as reducing response times and improving self-service options. This strategic planning ensures that the integration of AI agents aligns with the specific needs of the organization, ultimately enhancing customer experience management and improving client satisfaction.

Mobile banking applications are also evolving, incorporating advanced features such as biometric authentication and personalized dashboards. These enhancements enable individuals to manage their finances with greater ease and security. For instance, the integration of biometric security measures not only improves user experience but also addresses growing concerns about data protection and fraud.

Moreover, data analytics tools are being utilized to gain deeper insights into consumer behavior. This enables financial institutions to customize their offerings, ensuring that services are aligned with client needs and preferences. By harnessing these technologies, banks can enhance their customer experience management, promoting a more engaging and efficient interaction that ultimately drives loyalty and satisfaction.

The future of banking AI chatbots involves significant automation of operations and enhanced interactions, reinforcing the importance of these technologies in modern banking. The success of these initiatives is highlighted by case studies demonstrating the positive impact of technology on customer experience management. For example, organizations that have implemented AI-driven chatbots report significant improvements in response times and customer engagement metrics.

Zartis, with a 4.8/5 rating on Glassdoor, exemplifies how developer satisfaction translates into effective technology solutions, thereby enhancing overall delivery. As the banking landscape continues to evolve, the strategic use of technology in customer experience management will be crucial for meeting the demands of modern consumers and enhancing overall service delivery. Additionally, the growing acceptance of AI technologies is illustrated by OpenAI’s ChatGPT reaching over 200 million weekly users, doubling from 100 million in just under a year.

Best Practices for Effective Customer Experience Implementation

To effectively implement banking customer experience management strategies, institutions must adopt several key best practices. First and foremost, prioritizing client feedback is crucial; banks should regularly conduct surveys and leverage analytics to gain insights into client needs and preferences. This data-oriented method not only guides improvements but also fosters a culture of banking customer experience management.

Before execution, organizations must recognize their particular requirements, such as decreasing response time, enhancing self-help options, or boosting client satisfaction. Training staff to provide outstanding assistance is equally crucial, as employees frequently serve as the first point of contact for clients. Investing in comprehensive training programs is essential, equipping staff with the skills necessary to address client inquiries effectively and empathetically, thereby enhancing overall satisfaction.

Additionally, banks should invest in advanced technology to improve banking customer experience management by enabling seamless interactions. Integrated Customer Relationship Management (CRM) systems can significantly aid in this endeavor by providing a 360-degree view of the client, enabling personalized service and efficient issue resolution. This technological investment is vital for enhancing banking customer experience management across various channels.

For instance, the case study on self-service banking underscores the necessity of an omnichannel approach, allowing clients to resolve their financial needs independently, which significantly enhances satisfaction and engagement. Moreover, deploying AI agents can tackle delays in response time, offering immediate replies that enhance banking customer experience management. Ultimately, creating a culture of ongoing enhancement is essential for sustained success.

Consistently assessing and improving client engagement initiatives ensures that financial institutions remain attuned to changing consumer expectations. By cultivating an environment where feedback is actively pursued and implemented, financial institutions can significantly enhance their banking customer experience management, ultimately fostering loyalty and decreasing churn. Furthermore, establishing partnerships with clients fosters long-term relationships and reduces the likelihood of churn, underscoring the significance of banking customer experience management.

Overcoming Challenges in Banking Customer Experience

In 2025, banks confront significant challenges in managing customer experience, primarily stemming from outdated technology, regulatory compliance hurdles, and escalating client expectations. A considerable number of financial institutions continue to struggle with legacy systems, which not only hinder their capacity to provide seamless digital interactions but also complicate their operational agility. As Sean Albertson, a leader in client satisfaction, asserts, without effective management, tailored technology can quickly become obsolete, creating barriers as fintech evolves.

The regulatory landscape further complicates the integration of new technologies and processes, as compliance requirements can stifle innovation and slow down the implementation of customer-centric solutions. As Fiona Roach Canning, co-founder and CEO, aptly noted, “In 2025, banking customer experience management will be everything,” underscoring the critical need for financial institutions to prioritize client experience in their strategic initiatives.

To navigate these challenges, banks must commit to modernizing their infrastructure. This entails not only upgrading technology but also cultivating a culture of innovation that embraces change. Engaging with clients to gain insights into their expectations and pain points is essential for effective banking customer experience management and for developing solutions that resonate with their needs.

A pertinent case study illustrates this point: IKEA leveraged Google Cloud’s Recommendations AI to enhance its online client interaction by offering highly personalized product suggestions at scale, resulting in improved engagement and increased sales. Similarly, with rising fraud rates, 17% of bankers have identified real-time fraud detection as a pivotal technology trend for 2025. By investing in such technologies, community financial institutions can bolster security measures and protect against monetary losses, thereby enhancing client trust and satisfaction.

Furthermore, solutions like Zendesk for Financial Services provide banks with a comprehensive banking customer experience management solution that enables them to deliver secure and personalized services, thereby enhancing their relationships.

Moreover, the integration of AI agents can significantly enhance operational efficiency in banking customer experience management by delivering instant responses to inquiries, thus addressing delays in response time and improving overall satisfaction. Key features of these AI agents, such as Natural Language Processing (NLP) and machine learning, facilitate a more human-like interaction and ongoing improvement based on user engagements. These agents can also integrate with CRM and support systems, enriching client interactions by accessing client history and preferences.

Additionally, the analytics and reporting capabilities of AI agents provide valuable insights into client behavior and service trends, further supporting their implementation. This omnichannel assistance ensures that financial institutions can connect with clients across various platforms, further enriching the client interaction.

Ultimately, the path to overcoming legacy systems and enhancing banking customer experience management lies in a proactive approach to modernization and a profound understanding of client needs. By prioritizing these elements and leveraging advanced technologies, including solutions from Zartis, financial institutions can position themselves to thrive in an increasingly competitive landscape.

Measuring Success: The Role of Analytics in Customer Experience

Assessing banking customer experience management is imperative for financial institutions aiming to refine their strategies and enhance service delivery. Key performance indicators (KPIs) such as Net Promoter Score (NPS), Satisfaction Score (CSAT), and Effort Score (CES) are essential metrics that illuminate perceptions and satisfaction levels. For example, Nubank, a leading Brazilian FinTech, has consistently maintained a Net Promoter Score exceeding 85 by emphasizing customer-centric support across various channels, including email, live chat, and social media.

This approach has proven effective, as evidenced by their user base expanding from 10,000 to over 10 million.

Looking ahead to 2025, the integration of advanced analytics tools is crucial for financial institutions to discern trends and patterns in client behavior. These tools empower institutions to make informed, data-driven decisions that enhance client interactions. As financial institutions increasingly invest in data science, the focus on analytics becomes vital for elevating user satisfaction.

Moreover, the deployment of AI agents can significantly boost support efficiency by providing instantaneous responses, thereby mitigating delays in response time and enhancing overall satisfaction. AI agents, powered by artificial intelligence and machine learning, assist clients in resolving inquiries and delivering tailored responses, which is essential for maintaining engagement and satisfaction.

Regularly evaluating these metrics not only allows financial institutions to adapt their strategies but also fosters a culture of continuous improvement in service quality. Current KPIs for assessing client satisfaction in banking are integral to customer experience management and encompass metrics that evaluate service delivery effectiveness and client engagement. By concentrating on these indicators, banks can gain deeper insights into their performance and pinpoint areas for enhancement.

Expert opinions underscore that a robust measurement framework is essential for achieving long-term success in banking customer experience management, ultimately leading to increased client loyalty and satisfaction.

Additionally, clear communication of return policies and product information is critical to averting client confusion and cultivating trust. As HSBC Singapore has highlighted, their innovative solutions have been pivotal in delivering exceptional service, emphasizing the importance of adapting to client needs in a competitive landscape. Furthermore, Zartis’s dedication to social responsibility is exemplified through successful initiatives like Project Connect, which provided internet connectivity for students in Afghanistan, Tajikistan, Egypt, and Europe.

This initiative reflects a comprehensive understanding of client needs and community involvement, further enriching the client journey.

The Future of Customer Experience in Banking

The future of client interaction in banking is on the brink of a significant transformation, primarily driven by technological advancements and evolving client expectations. This evolution underscores the critical importance of effective banking customer experience management. As financial organizations increasingly harness AI and machine learning, banking customer experience management is set to become the norm, empowering institutions to deliver tailored financial solutions that meet individual client needs. This shift transcends mere trend; it signifies a fundamental redefinition of how financial institutions engage with their clients.

Furthermore, the anticipated integration of blockchain technology is expected to bolster security and transparency in transactions—essential components in cultivating client trust. In a fiercely competitive landscape where brand loyalty is paramount, financial institutions that prioritize banking customer experience management through exceptional client interactions are poised to gain substantial advantages. For instance, a focus on enhancing client interactions can lead to increased profitability through effective cross-selling and up-selling strategies, as satisfied clients are more inclined to engage with a bank’s offerings.

This perspective aligns with findings from the case study titled ‘Creating a Client-Focused Banking Environment,’ which emphasizes that banking customer experience management is vital for fostering client satisfaction, nurturing brand loyalty, and ensuring sustained growth.

Zartis exemplifies this commitment to social responsibility through initiatives like Project Connect, which provides internet connectivity for students in diverse regions, including Afghanistan and Egypt. Such initiatives not only enhance educational opportunities but also reflect a broader commitment to community engagement, resonating positively with clients. This commitment aligns with Zartis’s successful campaigns, showcasing their dedication to effecting change.

As Jane Barratt articulates, “People want relevant, personalized, and transparent interactions.” It is evident when something resonates personally; it is your data.

This statement underscores the necessity for consistent and tailored interactions in banking customer experience management, reinforcing the significance of personalization in enhancing client trust and engagement.

Looking ahead to 2025, the market value of AI in finance is projected to reach $37.15 billion, with a notable 80% of financial executives recognizing banking customer experience management as a critical factor for enhancing client interaction and operational efficiency. Key features of AI agents, including Natural Language Processing and Machine Learning, will be instrumental in addressing response time delays and optimizing support efficiency. This reality highlights the imperative for banks to remain agile and responsive to technological advancements, ensuring they consistently deliver exceptional banking customer experience management that aligns with the demands of a rapidly evolving market.

Conclusion

In the dynamic world of banking, Customer Experience Management (CEM) has emerged as a cornerstone for financial institutions aiming to enhance customer satisfaction and loyalty. With rising consumer expectations, banks must adopt innovative, technology-driven strategies that prioritize seamless interactions and personalized services. The urgency for banks to refine their customer journeys is underscored by the significant percentage of customers who cite poor service experiences as a primary reason for dissatisfaction.

The integration of advanced technologies, particularly AI and data analytics, plays a pivotal role in transforming customer interactions. By automating up to 90% of customer interactions and leveraging omnichannel approaches, banks can create a more engaging and efficient customer experience. Furthermore, investing in comprehensive training for staff and actively seeking customer feedback fosters a culture of continuous improvement, ensuring that institutions remain responsive to evolving needs.

As the banking landscape continues to evolve, the focus on CEM will not only drive customer loyalty but also contribute to significant revenue growth. Banks that prioritize customer-centric strategies, embrace technological advancements, and commit to understanding their clientele will be well-positioned to thrive in an increasingly competitive market. Ultimately, the future of banking lies in the ability to deliver exceptional, personalized experiences that resonate with customers, fostering trust and long-term relationships.

Frequently Asked Questions

What is Client Experience Management (CEM) in banking?

Client Experience Management (CEM) in banking refers to the strategies and processes that financial institutions use to enhance and streamline interactions with clients across various touchpoints.

Why is CEM becoming increasingly important for banks?

The significance of CEM has grown, with 43% of clients reporting dissatisfaction due to inadequate service interactions, highlighting the need for financial institutions to address client grievances and improve the overall client experience.

How do clients typically interact with banks?

Recent trends show that 73% of clients use multiple channels for their financial interactions, indicating the necessity for banks to adopt an omnichannel strategy.

What role do service statistics play in banking customer experience management?

By systematically monitoring service statistics, financial institutions can set performance benchmarks, identify inefficiencies, and tailor services to better align with client expectations.

How does effective banking customer experience management impact client loyalty?

A positive client experience is directly linked to increased retention rates, with organizations prioritizing customer experience management being statistically more likely to achieve significant revenue growth.

What technologies are shaping the future of banking support?

Continuous advancements in AI, such as AI agents and personalized recommendation systems, are crucial for refining service offerings and enhancing client interactions.

Can you provide an example of successful AI implementation in banking?

IKEA’s use of Google Cloud’s Recommendations AI demonstrates how personalized suggestions can significantly boost engagement and sales, illustrating the potential of AI in banking.

What are the expected trends in banking by 2030 regarding AI integration?

It is anticipated that AI integration will become standard in banking solutions, leading to innovative, AI-driven products and enhanced client interactions.

How are banks ensuring seamless client engagement across platforms?

Banks are prioritizing omnichannel strategies, allowing clients to engage seamlessly across various platforms, which enhances satisfaction and fosters loyalty.

What challenges are banks expected to face by 2025?

The regulatory landscape will become more complex, requiring financial institutions to adopt compliance technologies that address new rules related to data privacy, cybersecurity, and sustainability.